SECURITIES AND EXCHANGE COMMISSION

__________________________

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

__________________________

Filed by the Registrant x Filed by a Party other than the Registrant ¨o Check the appropriate box:

| | | | | |

¨ | o | Preliminary Proxy Statement |

| |

¨ | o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

¨ | o | Definitive Additional Materials |

| |

¨ | o | Soliciting Material Pursuant to § 240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| |

| x | | No fee required. |

| |

¨ | o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | |

| (2) | | Aggregate number of securities to which transaction applies: |

| | |

| (3) | | Per unit price orof other underlying value of transactiontransactions computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid:

|

| | |

¨ | (5) | Total fee paid: |

| | |

| o | Fee paid previously with preliminary materials. |

| |

¨ | o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.filing |

| (1) | Amount Previously Paid: |

| | |

| | (1) | | Amount Previously Paid:

|

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party:

|

| (3) | Filing Party: |

| | |

| (4) | | Date Filed: |

| | |

| | |

405 Lexington Avenue, 17th Floor

You are cordially invited to attend the 20162021 Annual Meeting of Stockholders (the “Annual Meeting”) of OUTFRONT Media Inc., which will be held at 605 Third Avenue, New York, New York, 10158, on June 7, 2016,8, 2021, at 10:00 a.m., Eastern Daylight Time. Due to the ongoing novel coronavirus (“COVID-19”) pandemic and resulting concerns about the health and the safety of our stockholders, employees, directors and the greater community, and in order to provide expanded access, improved communication and cost savings for our stockholders, the Annual Meeting will again be a virtual meeting. You will be able to attend the Annual Meeting and vote and submit questions during the Annual Meeting via a live audio webcast by visiting

www.virtualshareholdermeeting.com/OUT2021 and by following the procedures set forth in the proxy materials.

The matters expected to be acted upon at the meeting are described in detail in the accompanying Notice of Annual Meeting of Stockholders and proxy statement.

Your vote is important to us. Whether or not you plan to attend the Annual Meeting

by webcast, we strongly urge you to cast your vote promptly. The enclosed materials contain instructions on how you can exercise your right to vote over the internet, by telephone or by mail.

Thank you for your continued support of OUTFRONT Media Inc.

Sincerely,

JEREMY J. MALE

Chairman and Chief Executive Officer

| | | | | |

| Sincerely, |

| |

| JEREMY J. MALE |

| Chairman and Chief Executive Officer |

| |

OUTFRONT Media Inc.

405 Lexington Avenue, 17th Floor

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To OUTFRONT Media Inc. Stockholders:

Notice is hereby given that the 20162021 Annual Meeting of Stockholders (the “Annual Meeting”) of OUTFRONT Media Inc., a Maryland corporation (the “Company”), will be held at 605 Third Avenue, New York, New York, 10158, on June 7, 2016,8, 2021, at 10:00 a.m., Eastern Daylight Time.Time via a live audio webcast located at www.virtualshareholdermeeting.com/OUT2021. The Annual Meeting will be held forto consider and vote upon the following purposes: | 1. | To elect the Class II director nominee named in this proxy statement to serve until the 2019 Annual Meeting of Stockholders and until his successor is duly elected and qualifies. |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for fiscal year 2016. |

| 3. | To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers. |

| 4. | To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

proposals:

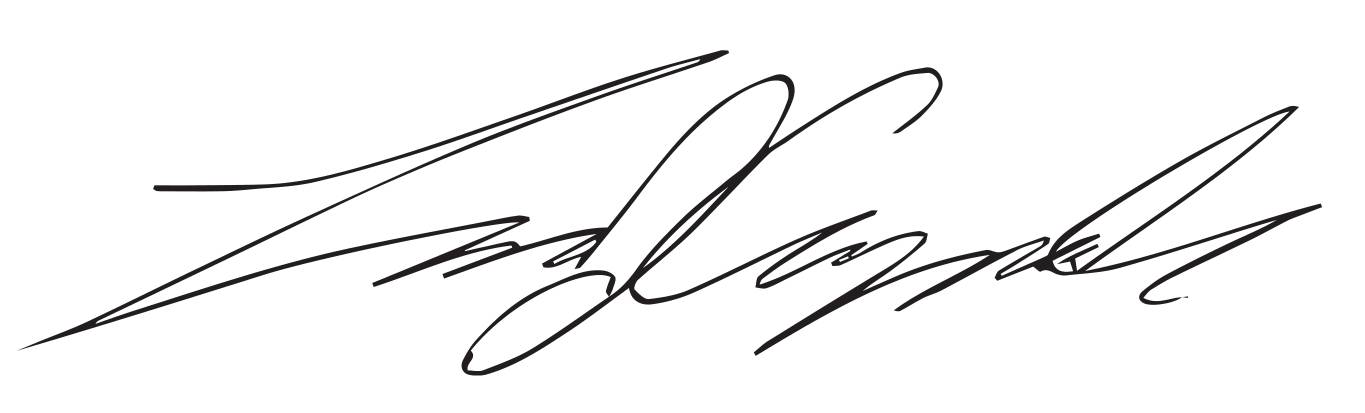

1.To elect the four Class I director nominees, named in this proxy statement, each to serve until the 2022 Annual Meeting of Stockholders and until his or her successor is duly elected and qualifies.

2.To ratify the appointment of PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for fiscal year 2021.

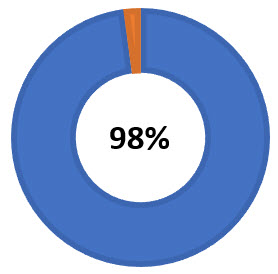

3.To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers.

4.To determine, on a non-binding advisory basis, whether a non-binding advisory vote to approve the compensation of the Company’s named executive officers should occur every one, two or three years.

5.To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

Only stockholders of record at the close of business on April

15, 20169, 2021 are entitled to notice of, and to vote at, the Annual Meeting or any postponement or adjournment thereof. Each stockholder of record is entitled to one vote for each share of common stock held at that time.

Your vote is important to us. You may cast your vote over the internet, by telephone, or by mail.

We mailed a Notice of Internet Availability of Proxy Materials on or about April

21, 2016.23, 2021.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on June 7, 2016:8, 2021: the Company’s proxy statement and 20152020 annual report to stockholders are available atwww.proxyvote.com.By Order of the Board of Directors,

RICHARD H. SAUER

Executive Vice President, General Counsel and

Secretary

April 21, 2016

TABLE OF CONTENTS

TABLE OF CONTENTS

OUTFRONT Media Inc.

405 Lexington Avenue, 17th Floor

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

What are proxy materials?

OUTFRONT Media Inc., a Maryland corporation (the “Company,” “we,” “our” or “us”), made these proxy materials available to you via the internet or, upon your request, have delivered printed versions of these proxy materials to you by mail in connection with the solicitation by the Board of Directors (the “Board” or “Board of Directors”) of the Company of proxies to be voted at the Company’s

20162021 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on June

7, 2016,8, 2021, at 10:00 a.m., Eastern Daylight Time

via a live audio webcast, and at any postponement or adjournment of the Annual Meeting. The Notice of Internet Availability of Proxy Materials, proxy statement and form of proxy are being distributed and made available on the internet on or about April

21, 2016,23, 2021, to all stockholders entitled

to notice of, and to vote at, the Annual Meeting. As a stockholder, you are invited to attend the Annual Meeting

via webcast and are requested to vote on the items of business described in this proxy statement. This proxy statement includes information that we are required to provide to you under

the U.S. Securities and Exchange Commission

(“SEC”(the “SEC”) rules, and is designed to assist you in voting your shares. The proxy materials include this proxy statement for the Annual Meeting, an annual report to stockholders, including our Annual Report on Form 10-K for the year ended December 31,

2015,2020, and the proxy card or a voting instruction

cardform for the Annual Meeting.

Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

In accordance with the SEC rules, we may furnish proxy materials, including this proxy statement and our annual report, to our stockholders by providing access to such documents on the internet instead of mailing printed copies. Accordingly, we are sending the Notice of Internet Availability of Proxy Materials to our stockholders of record and beneficial owners as of the close of business on April

15, 20169, 2021 (the “Record Date”) on or about April

21, 2016.23, 2021. Stockholders receiving a Notice of Internet Availability of Proxy Materials by mail will not receive a printed copy of proxy materials, unless they so request. Instead, the Notice of Internet Availability of Proxy Materials will instruct stockholders as to how they may access and review proxy materials on the internet. Stockholders who receive a Notice of Internet Availability of Proxy Materials by mail who would like to receive a printed copy of the Company’s proxy materials, including a proxy card or voting instruction

card,form, should follow the instructions for requesting these materials included in the Notice of Internet Availability of Proxy Materials. Stockholders who currently receive printed copies of proxy materials who would like to receive future copies of these documents electronically instead of by mail should follow the instructions for requesting electronic delivery set forth in the proxy card, the form of which is included

inwith this proxy statement.

I share an address with another stockholder. Why did we receive only one copy of the proxy materials and how may I obtain an additional copy of the proxy materials?

The SEC has adopted rules that permit companies and intermediaries such as brokers to satisfy the delivery requirements for a Notice of Internet Availability of Proxy Materials or other

annual meetingAnnual Meeting materials, including this proxy statement and the annual report to stockholders, with respect to two or more stockholders sharing the same address by delivering a single Notice of Internet Availability of Proxy Materials or other annual meeting materials addressed to those stockholders. This process, which is commonly referred to as “householding,” is intended to provide extra convenience for stockholders and cost savings for companies.

A number of brokers with account holders who are our stockholders will be “householding” our proxy materials. A single Notice of Internet Availability of Proxy Materials, proxy statement or annual report of stockholders, as applicable, will be delivered to multiple stockholders sharing an address unless contrary

instructions have been received from the affected stockholders. If you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate Notice of Internet Availability of Proxy Materials, proxy statement or annual report to stockholders, as applicable, please notify your broker if your shares are held in a brokerage account, or the Company’s Corporate Secretary at the address or

telephone number below if you hold registered shares. If you have multiple accounts in your name or share an address with other stockholders, you

canmay also request “householding” and authorize your broker to discontinue mailings of multiple copies of the Notice of Internet Availability of Proxy Materials, proxy statement or annual report

to stockholders, as applicable, by notifying your broker if your shares are held in a brokerage account, or the Company’s

Corporate Secretary at the address or telephone number below if you hold registered shares. Upon request, we will deliver promptly a copy of the Notice of Internet Availability of Proxy Materials, proxy statement or annual report

to stockholders, as applicable, to stockholders at a shared address to which a single copy of these documents was delivered. Stockholders can submit this request by contacting the Company’s

Corporate Secretary, at OUTFRONT Media Inc., 405 Lexington Avenue, 17th Floor, New York, New York 10174, (212) 297-6400.

What items of business will be voted on at the Annual Meeting?

There are

34 proposals scheduled to be

considered and voted on at the Annual Meeting:

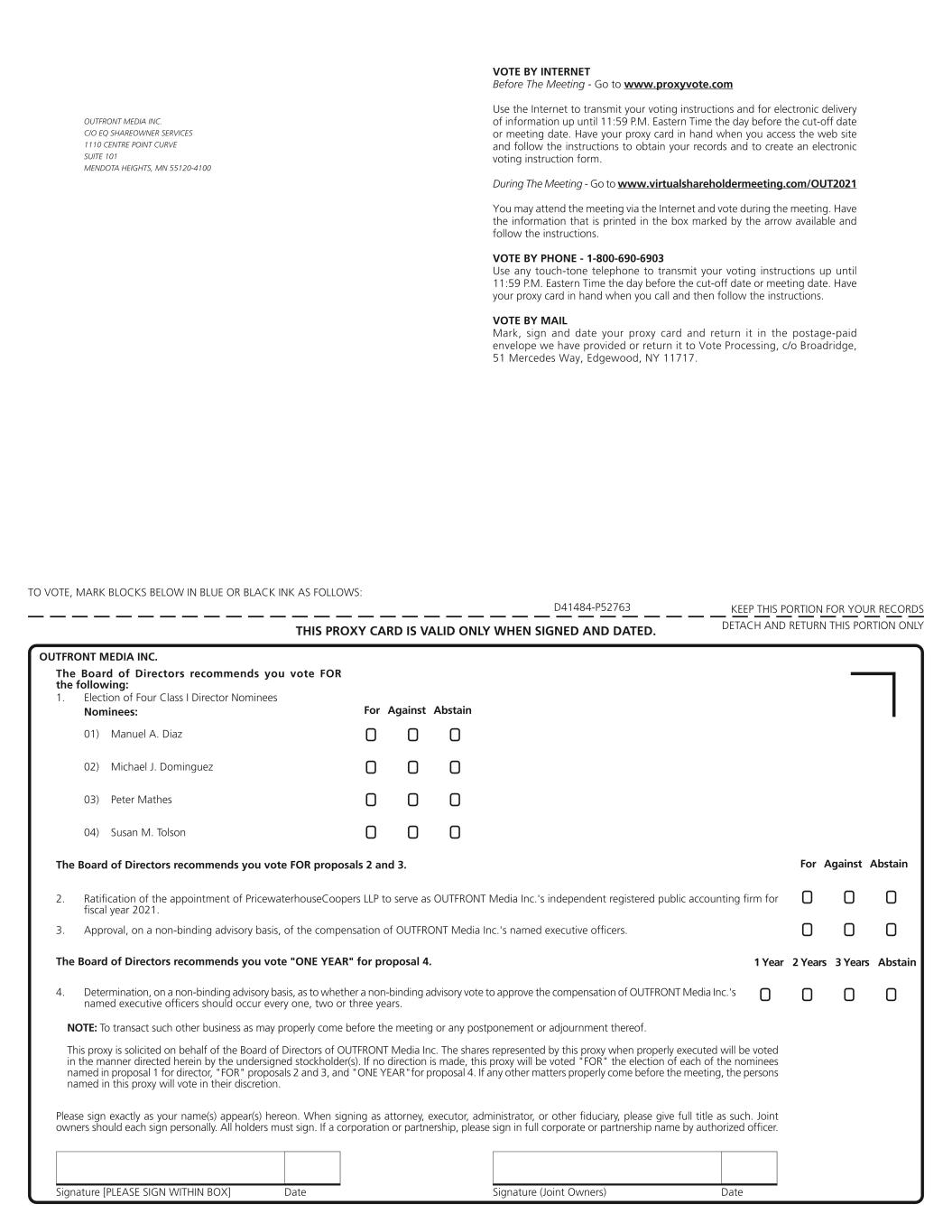

•Proposal No. 1: The election of the four Class III director nomineenominees named in this proxy statement, each to serve until the 20192022 Annual Meeting of Stockholders and until his or her successor is duly elected and qualifies.

•Proposal No. 2: The ratification of the appointment of PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for fiscal year 2016.2021.

•Proposal No. 3: The approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers, as disclosed in this proxy statement.

•Proposal No. 4: The determination, on a non-binding advisory basis, as to whether a non-binding advisory vote to approve the compensation of the Company’s named executive officers should occur every one, two or three years.

How does the board of directors recommend I vote on these proposals?

•“FOR” election of the four Class III director nomineenominees named in this proxy statement.

•“FOR” ratification of the appointment of PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for fiscal year 2016.2021.

•“FOR” approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers, as disclosed in this proxy statement.

•“ONE YEAR” with respect to the determination, on a non-binding advisory basis, as to whether a non-binding advisory vote to approve the compensation of the Company’s named executive officers should occur every one, two or three years.

Who is entitled to vote at the Annual Meeting?

Stockholders as of the close of business on the Record Date may vote at the Annual Meeting. As of the Record Date, there were

137,914,417145,538,216 shares of our common stock, par value $0.01 per share

(“common stock”) and 400,000 shares of our Series A Convertible Perpetual Preferred Stock, par value $0.01 per share (“Series A Preferred Stock”), outstanding. You are entitled to one vote for each share of common stock held by you as of the Record Date.

At the Annual Meeting, each share of Series A Preferred Stock entitles the record holder of Series A Preferred Stock to 16 votes per share, which is the number of votes equal to the largest number of whole shares of common stock into which each share of Series A Preferred Stock could be converted as of the Record Date. Thus, holders of shares of Series A Preferred Stock are entitled to an aggregate of 6,400,000 votes for each director nominee and on each other proposal considered and voted upon at the Annual Meeting, and will vote as a single class with the holders of our common stock at the Annual Meeting. Accordingly, the aggregate number of votes that may be cast by the holders of our common stock and our Series A Preferred Stock at the Annual Meeting, voting together as a single class, is 151,938,216 votes.

If your shares are registered directly in your name with our transfer agent,

Wells Fargo Bank N.A.,EQ Shareowner Services, you are considered the stockholder of record with respect to those shares, and the Notice of Internet Availability of Proxy Materials was provided to you directly. As the stockholder of record, you have the right to vote by proxy or to vote in person at the Annual

Meeting.Meeting by webcast.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and the Notice of Internet Availability of Proxy Materials was forwarded to you by your broker or nominee, who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares. Beneficial owners are also invited to attend the Annual

Meeting. However, since you are not the stockholder of record, youMeeting by webcast and may

notbe eligible to vote

yourtheir shares

in person at the Annual Meeting

unless youusing the procedures outlined by their broker or other nominee. Certain street name holders may be required to follow

your broker’s procedures for obtaining a “legal

proxy”.proxy,” which may take several days to obtain. The material from your broker, bank or other nominee will include a voting instruction form or other document by which you

canmay instruct your broker, bank or other nominee how to vote your shares.

A quorum is required for our stockholders to conduct business at the Annual Meeting. Under the Company’s Amended and Restated Bylaws (the “Bylaws”), the presence, in person or by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting

on any matter will constitute a quorum at the Annual Meeting.

Dissenters’ rights are not applicable to any of the matters being voted upon at the Annual Meeting.

What votes are required with respect to each proposal?

Proposal No. 1, the

nomineenominees for Class

III director will be elected by

the affirmative vote of a

pluralitymajority of the votes cast

in person or represented by proxy at the Annual Meeting and entitledwith regard to

vote on the election of directors,such nominee, which means that the

nominee receiving the highest number of

affirmative votes

will be elected.“for” each nominee must exceed the number of votes “against” such nominee.

Proposal No. 2, the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for

the fiscal year

2016, will be determined by2021, requires the affirmative vote of a majority of

all the votes cast

in person or represented by proxy aton the

Annual Meeting and entitled to vote.matter, which means that the number of votes “for” the proposal must exceed the number of votes “against” the proposal.

Proposal No. 3, the non-binding advisory vote to approve the compensation of the Company’s named executive officers, as disclosed in this proxy statement,

will be determined byrequires the affirmative vote of a majority of

all the votes cast

in person or represented by proxy aton the

Annual Meeting and entitled to vote.matter, which means that the number of votes “for” the proposal must exceed the number of votes “against” the proposal. As an advisory vote, this proposal is not binding. However, the Board will consider the outcome of the vote when making future compensation decisions for our named executive officers.

Proposal No. 4, the non-binding advisory vote on whether a non-binding advisory vote to approve the compensation of the Company’s named executive officers should occur every one, two or three years, will be determined by the affirmative vote of a majority of the votes cast on the matter, which means that the number of votes for either “one”, “two” or “three” years must represent a majority of the number of votes cast for these three options in the aggregate. In the event that no option receives a majority of the votes cast, the Company will consider the option that receives the most votes to be the option selected by our stockholders. As an advisory vote, this proposal is not binding. However, the Board will consider the outcome of the vote when making future decisions regarding the frequency of future votes on the compensation of our named executive officers.

How are broker non-votesvotes counted?

With respect to each of Proposals Nos. 1, 2, and

abstentions counted?3, you may vote “for”, “against” or “abstain” from voting on any such proposal.

With respect to Proposal No. 4, you may vote “one year”, “two years”, “three years” or “abstain”.

A broker non-vote occurs when shares held by a broker are not voted with respect to a particular proposal because the broker does not have discretionary authority to vote on the matter and has not received voting instructions from its clients. If your broker holds your shares in its name and you do not instruct your broker how to vote, your broker will only have discretion to vote your shares on “routine” matters. Where a proposal is not “routine,” a broker who has received no instructions from its clients does not have discretion to vote its clients’ uninstructed shares on that proposal. At the Annual Meeting, only Proposal No. 2, the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for

the fiscal year

2016,2021, is considered a routine matter. Your broker will therefore not have discretion to vote on Proposals Nos. 1,

3 and

3,4, but will have discretion to vote on Proposal No. 2.

Pursuant to Maryland law, abstentions and broker non-votes are counted as present for purposes of determining the presence of a quorum. For purposes of Proposals Nos. 1, 2,

3 and

3,4, abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote.

If any nominee for director in an uncontested election receives a greater number of “against” votes than votes “for” his or her election (a “Majority Against Vote”), the nominee has not received the requisite votes needed to be elected to the Board and the Company’s Corporate Governance Guidelines require that such incumbent director nominee promptly tender a written offer of resignation to the Chairman of the Board. The Nominating and Governance Committee of the Board (the “Nominating and Governance Committee”) will promptly consider the director’s offer of resignation and recommend to the Board whether to accept the tendered resignation or to take some other action, such as rejecting the tendered resignation and addressing the apparent underlying causes of the Majority Against Vote. In making this recommendation, the Nominating and Governance Committee will consider all factors deemed relevant by its members, including, without limitation, the stated reason or reasons why the stockholders voted “against” the election of the applicable director (if ascertainable), the qualifications of the director whose resignation has been tendered, the director’s contributions to the Company, the overall composition of the Board and whether by accepting such resignation, the Company will no longer be in compliance with any applicable law, rule, regulation or governing document (including the New York Stock Exchange (“NYSE”) listing standards, federal securities laws or the Company’s Corporate Governance Guidelines), and whether or not accepting the resignation is in the best interests of the Company and its stockholders. The Board will act on the Nominating and Governance Committee’s recommendation within 90 days following certification of the stockholder vote. In considering the Nominating and Governance Committee’s recommendation, the Board will consider the information, factors, and alternatives considered by the Nominating and Governance Committee and such additional information, factors and alternatives as the Board believes to be relevant. Following the Board’s decision, the Company will publicly disclose the Board’s decision. The director who tenders his or her offer of resignation will not participate in the decisions of the Nominating and Governance Committee or the Board that concern the resignation.

How can I attend and vote at the Annual Meeting?

The Annual Meeting will be a virtual meeting of stockholders, as it was last year. You maywill be able to attend and vote and submit questions during the Annual Meeting and vote in personvia a live audio webcast by completing a ballot. Space for the Annual Meeting is limited. Therefore, admissionvisiting www.virtualshareholdermeeting.com/OUT2021, which will bebegin on a first-come, first-served basis. Registration will open at 9:00 a.m., Eastern Daylight Time, and the Annual Meeting will beginJune 8, 2021 at 10:00 a.m., Eastern Daylight Time. Each stockholder shouldThe rules of conduct for the Annual Meeting will be preparedavailable on www.virtualshareholdermeeting.com/OUT2021 during the Annual Meeting.

Stockholders will need their unique 16-digit control number, which appears on the Notice of Internet Availability of Proxy Materials or your proxy card that accompanied the proxy materials, or which may be included in the materials forwarded to

present:Valid government photo identification, such asyou by your broker or other nominee. In the event that you do not have a driver’s license or passport;

Proof of ownership of our common stock as of the Record Date, such as a recent account statement reflecting stock ownership, a brokerage statement or letter provided by acontrol number, please contact your broker bank, trustee or other nominee or similar evidenceas soon as possible and no later than Tuesday, May 25, 2021, so that you can be provided with a control number and gain access to the virtual Annual Meeting.

Online access to the audio webcast will open approximately 15 minutes prior to the start of ownership;the Annual Meeting to allow time for you to log in and

test the computer audio system. We encourage our stockholders to access the Annual Meeting prior to the start time. If you hold your shares in street name, a “legal proxy” obtained fromrequire technical support, please call (844) 986-0822 (or internationally, (303) 562-9302), which is available 30 minutes prior to the broker, bank or other nominee that holds your shares authorizing you to vote your shares held in street name atstart of the Annual Meeting through the conclusion of the Annual Meeting.

Use of cameras, recording devices, computers and other electronic devices, such as smart phones and tablets, will not be permitted at the Annual Meeting.

How can I vote my shares without attending the Annual Meeting?

If you are a stockholder of record, you may

authorize a proxy to vote

by granting a proxy.your shares. Specifically, you may

authorize a proxy to vote:

| • | | | | |

| By Internet—If you have internet access, you may submit your proxy by going to www.proxyvote.com and by following the instructions on how to complete an electronic proxy card. You will need the16-digit control number included on your Notice of Internet Availability of Proxy Materials or your proxy card in order to authorize a proxy to vote by internet. Internet voting is available until 11:59 p.m., Eastern Daylight Time, on June 6, 2016.7, 2021. |

| • |

| | By Telephone—If you have access to a touch-tone telephone, you may submit your proxy by calling the telephone number specified on your Notice of Internet Availability of Proxy Materials or your proxy card and by following the recorded instructions. You will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials or your proxy card in order to authorize a proxy to vote by telephone. Telephone voting is available until 11:59 p.m., Eastern Daylight Time, on June 6, 2016.7, 2021. |

| • |

| | By Mail—You may authorize a proxy to vote by mail by requesting a proxy card from us, indicating your vote by completing, signing and dating the card where indicated and by mailing or otherwise returning the card in the envelope that will be provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity. If you sign and submit your proxy card without voting instructions, your shares will be voted “FOR” theeach director nominee named in this proxy statement with respect to Proposal No. 1, and “FOR” Proposals Nos. 2 and 3 and “ONE YEAR” for Proposal No. 4 as recommended by the Board, and in accordance with the discretion of the holders of the proxy with respect to any other matter that may be voted on atproperly come before the Annual Meeting.Meeting or any postponement or adjournment thereof. |

If you hold your shares in street name, you may also submit voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the internet, by telephone or by mail. Please refer to information from your bank, broker, or other nominee on how to submit voting instructions.

How do I change or revoke my proxy?

You may change your vote and revoke your proxy at any time prior to the vote at the Annual Meeting. If you are the stockholder of record, a proxy may be revoked by a writing delivered to the Company’s

Corporate Secretary, at OUTFRONT Media Inc., 405 Lexington Avenue, 17th Floor, New York, New York 10174, stating that the proxy is revoked, by a subsequent proxy that is signed by the person who signed the earlier proxy and is delivered before or at the Annual Meeting, by

voting againauthorizing a new proxy to vote on a later date on the internet or by telephone (only your latest internet or telephone proxy submitted prior to the Annual Meeting will be counted), or by attendance at the Annual Meeting and voting in

person.person via webcast. Attendance alone, without voting, will not be sufficient to revoke a previously authorized proxy. If your shares are held in street name, you may change your vote by submitting new voting instructions to your broker, bank or other nominee following the

instructioninstructions it has provided, or, if you have obtained a “legal proxy” from your broker or nominee giving you the right to vote your shares, by attending the Annual Meeting and voting in

person.person via webcast.

A representative of IOE Services Inc. will serve as the inspector of election for the Annual Meeting, and will tabulate the votes.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by our directors, officers or employees in person or by mail, telephone, facsimile, electronic transmission or other means. Our directors, officers or employees do not receive additional compensation for soliciting proxies. Brokers, banks and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for theirtheir reasonable expenses. We have also engaged GeorgesonMacKenzie Partners, Inc. to serve as our proxy solicitor for the Annual Meeting at a fee of $10,000,$11,000, plus reimbursement of reasonable expenses. GeorgesonMacKenzie Partners, Inc. will, among other things, provide advice relating to the content of solicitationsolicitation materials, solicit banks, brokers, nominees and institutional investors to determine voting instructions, and monitor voting and coordinate the delivery of executed proxies to our voting tabulator.voting.

Whom should I contact if I have questions about the Annual Meeting?

If you have any additional questions about the Annual Meeting,

or how to vote

in personvia webcast or otherwise, please contact our proxy solicitor,

GeorgesonMacKenzie Partners, Inc., at

(888) 680-1529(800) 322-2885 (toll-free) or

(781) 575-2137(212) 929-5500 (international callers).

For directions to the Annual Meeting, pleasePlease contact our Investor Relations Department, at

investor@outfrontmedia.com.investor@outfrontmedia.com, for other inquiries.

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The following table sets forth information as of March 31,

20162021 regarding the individuals who serve as our executive officers, excluding Mr. Male’s biographical information. Mr. Male’s biographical information can be found in the section entitled “—Board of Directors” below.

| | | | | | | | | | | | | | |

Name | | Age | | Position |

Jeremy J. Male | | 5863 | | Chairman and Chief Executive Officer |

Donald R. Shassian

Matthew Siegel | | 6058 | | Executive Vice President, Chief Financial Officer |

Clive Punter | | 4954 | | Executive Vice President, Chief Revenue Officer |

Richard H. Sauer | | 5863 | | Executive Vice President, General Counsel and Secretary |

Jodi Senese | | 5762 | | Executive Vice President, Chief Marketing Officer |

Andrew R. Sriubas | | 4752 | | Executive Vice President, Strategic Planning & DevelopmentChief Commercial Officer |

Nancy Tostanoski | | 5257 | | Executive Vice President, Chief Human Resources Officer |

None of our executive officers is related to each other or any director of the Company by blood, marriage or adoption.

Donald R. Shassian

Matthew Siegel has served as the Company’s Executive Vice President, Chief Financial Officer since November 2013.June 2018. Prior to that, heMr. Siegel served as the Executive Vice President and Chief Financial Officer of FrontierCBS Radio Inc. from November 2016 to November 2017, where he was responsible for all financial functions of the business, including treasury, investor relations, financial planning, corporate accounting and risk management, prior to its merger with Entercom Communications Corporation from 2006 to 2013.Corp. in November 2017. Before that, heMr. Siegel served as an M&A consultant for communications companies pursuing the acquisitionCo-Chief Financial Officer, Senior Vice President and divestitureTreasurer of local exchange businesses.Time Warner Cable Inc. from 2015 to 2016, and as Senior Vice President and Treasurer of Time Warner Cable Inc. from 2008 to 2015. Previously, he served as Executive Vice President/Chief Financial Officer and later Chief Operating Officer of RSL Communications, Ltd., Senior Vice President and Chief Financial OfficerAssistant Treasurer of Southern New England Telecommunications Corporation and as a partner at Arthur Andersen. Mr. Shassian served on the board of directors and as chairman of the audit committee of UIL Holdings CorporationTime Warner Inc. from October 20082001 to December 2015.2008.

Clive Punterhas served as the Company’s Executive Vice President, Chief Revenue Officer since October 2014. Prior to that, he was a founding partner of GeniusQ, a senior executive consulting company, from 2012 to 2014. Prior to that, he served as a managing director at LinkedinLinkedIn Corporation from 2010 to 2012, where he led the global marketing solutions business. Mr. Punter previously served in various roles at CBS Outdoor International (n/k/a(now known as Exterion Media) from 1995 to 2010, including as International CEO from 2007 to 2010.

Richard H. Sauerhas served as the Company’s Executive Vice President, and General Counsel since December 2006. Beginning in March 2014, he also began servingHe served as the Company’s Secretary.Corporate Secretary from March 2014 to June 2017. Prior to that, he was a partner at the law firm Duane Morris LLP and, before that, a partner at the law firm Jones Day.

Jodi Senesehas served as the Company’s Executive Vice President, Chief Marketing Officer since April 2013. Prior to that, she served as the Company’s Executive Vice President, Marketing from 2001 to 2013, overseeing all aspects of marketing, public relations, research and creative services, as well as the development of new business strategies for the Company. Previously, she served as Executive Vice President, Marketing at TDI Worldwide Inc. (which was later acquired by the Company) from 1990 to 2001. Before that, she served as Vice President, Marketing at Gannett Outdoor (which was later acquired by the Company) from 1988 to 1990. Ms. Senese began her career in sales at New York Subways Advertising Company (which was later acquired by the Company) in 1981. She served as Chairwoman of the Outdoor Advertising Association of America Marketing Committee from 2009 through 2013. Ms. Senese currently serves on the board of directors of Geopath, Inc.

Andrew R. Sriubashas served as the Company’s Executive Vice President, Chief Commercial Officer since July 2017. Prior to that, he served as the Company’s Executive Vice President, Strategic Planning & Development sincefrom July 2014.2014 to July 2017. Prior to that, heMr. Sriubas served as Chief of Strategy & Corporate Development at Sonifi Solutions, Inc. from 2013 to 2014, where he was responsible for corporate partnerships, product development, content acquisitions and digital deployment systems. Before joining Sonifi, from 1989 to 2013, Mr. Sriubas held senior roles at Citicorp Securities, Inc., Donaldson, Lufkin & Jenrette/Credit Suisse First Boston, UBS Investment Bank, JP Morgan Chase and Moorgate Partners, advising and raising capital for technology, media and telecommunications companies. Mr. Sriubas currently serves on the board of directors of the Media Rating Council and on the advisory board of Palisades Ventures, L.L.C.

Nancy Tostanoskihas served as the Company’s Executive Vice President, Chief Human Resources Officer since February 2015 and prior2015. Prior to that she served as the Company’s Senior Vice President, Human Resources sincefrom May 2014.2014 to February 2015. Ms. Tostanoski also served as Vice President, Global Compensation and Benefits at PVH Corp. (formerly known as The Warnaco Group, Inc.) from 2010 to 2013, where she was responsible for global compensation, benefits and performance management for the publicly-held branded apparel company. From 2007 to 2010, Ms. Tostanoski served as Vice President, Global Compensation, Benefits and Shared Services at Reader’s Digest Association, Inc., where she was responsible for global compensation, benefits and U.S. shared services for the privately-held publishing and media company.

Our business and affairs are managed under the direction of the Board. The Company’s Charter (the “Charter”) provides that the number of directors on the Board is fixed exclusively by the Board pursuant to our Bylaws, but may not be fewer than the minimum required by Maryland law, which is currently one. The Bylaws provide that the Board will consist of not less than one and not more than 15 directors. The Board currently consists of

seveneight directors.

On April 7, 2016, the Board voted to reduce its size from seven directors to six directors, effective at the commencement of the Annual Meeting. See “—Election

and Classification of Directors.” During

2015,2020, the Board held seven meetings and also acted by unanimous written consent

twofour times. Each incumbent director attended at least 75% of (1) the total number of meetings of the Board held during the period

for whichthat he or she has been a director and (2) the total number of meetings held by all committees of the Board on which such director served during the periods that he or she served during

2015.2020. In addition to Board and committee meetings, directors are invited and expected to attend the Annual Meeting.

FiveSix of

our sixthe seven directors then serving attended the

2015 annual meeting2020 Annual Meeting of

stockholders.Stockholders.

In accordance with the

New York Stock Exchange (“NYSE”)NYSE listing standards, the non-management and independent directors meet separately in executive sessions, without directors who are Company employees, at least two times each year, and at such other times as they deem appropriate. During

2015,2020, the Company’s

non-management and independent directors met in executive session three times, and the Lead Independent Director presided at

all of the executive

sessions of non-management and independent directors, and during 2015, the non-management and independent directors met six times.sessions.

The following table sets forth information as of March 31,

20162021 regarding individuals who serve as members of the Board.

| | | | | | | | | | | | | | | | | |

Name | | | Age | | Position |

William Apfelbaum

Nicolas Brien | | 69 | 59 | | Director |

Nicolas Brien

Angela Courtin | | 54 | 47 | | Director |

Manuel A. Diaz | | 61 | 66 | | Director |

Michael J. Dominguez | | | 51 | | Director |

| Jeremy J. Male | | 58 | 63 | | Chairman and Chief Executive Officer |

Peter Mathes | | 63 | 68 | | Director |

Susan M. Tolson | | 54 | 59 | | Director |

Joseph H. Wender* | | 71 | 76 | | Director |

*Lead Independent Director

None of our directors is related to each other or any executive officer of the Company by blood, marriage or adoption.

William Apfelbaum has served

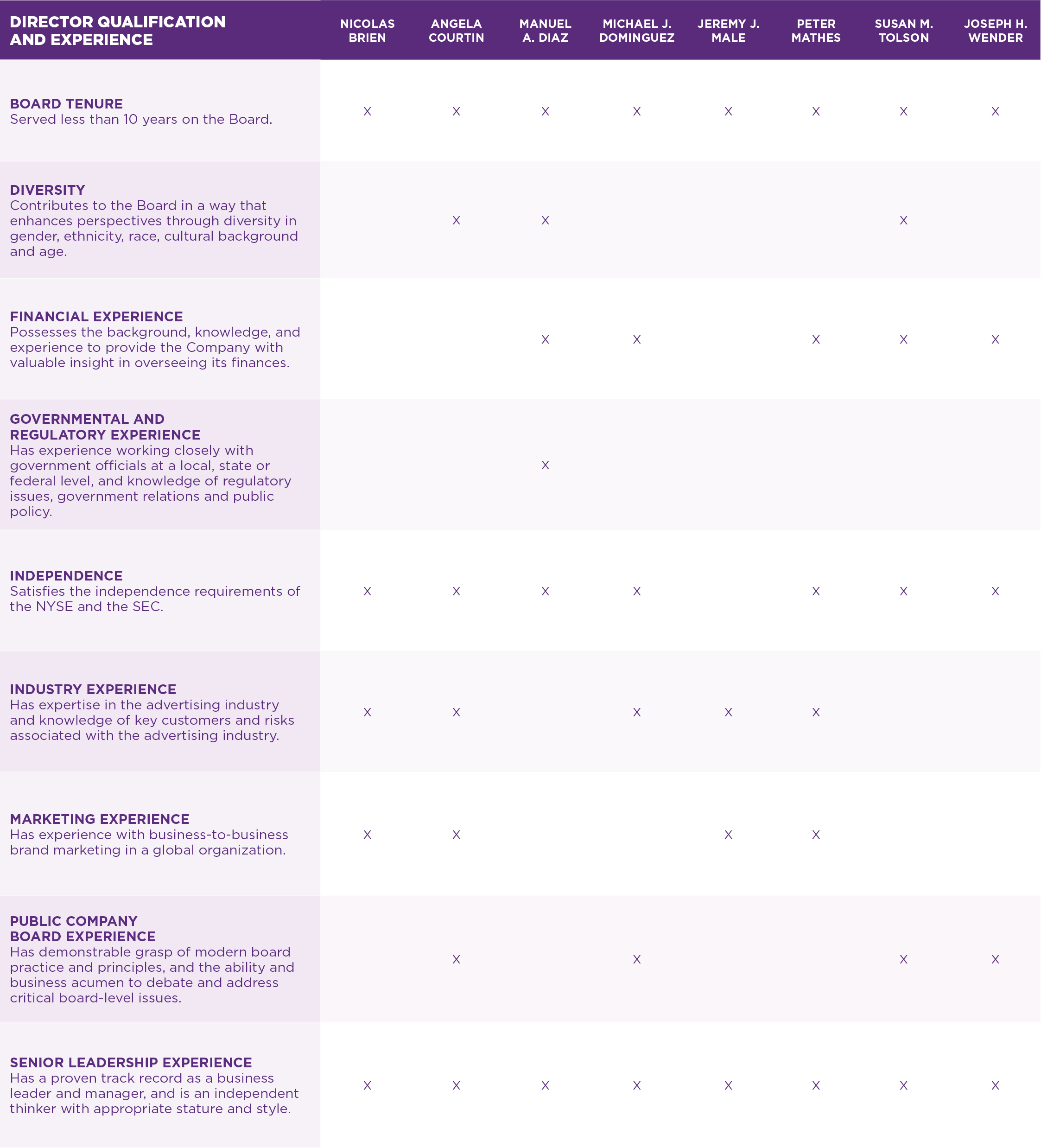

The Board believes that all of the directors are highly qualified and have specific employment and leadership experiences, qualifications, and skills that qualify them for service on the

Board since June 2015Board. The specific experiences, qualifications and

will continue to serve onskills that the Board

until the end of his term at the commencement of the Annual Meeting. He is currently a venture partner at several private equity firms, and serves or has served on the boards of a number of their private portfolio companies. Mr. Apfelbaum founded and served as the Chairman of Titan Outdoor Advertising from 2001 to 2011. Prior toconsidered in determining that

he served as President, Chairman and Chief Executive Officer of TDI Worldwide Inc. (which was later acquired by the Company) from 1989 to April 2000. Before that, Mr. Apfelbaum served as the President of Gannet Transit(formerly New York Subways Advertising Co., Inc., which was later acquired by the Company). We believe Mr. Apfelbaum is qualified tosuch person should serve as a member of the Board because with over 35 years of experiencedirector are included in their biographies and also summarized in the outdoor advertising industry, as well as experience advising portfolio companies, following table:

| | | | | | | | |

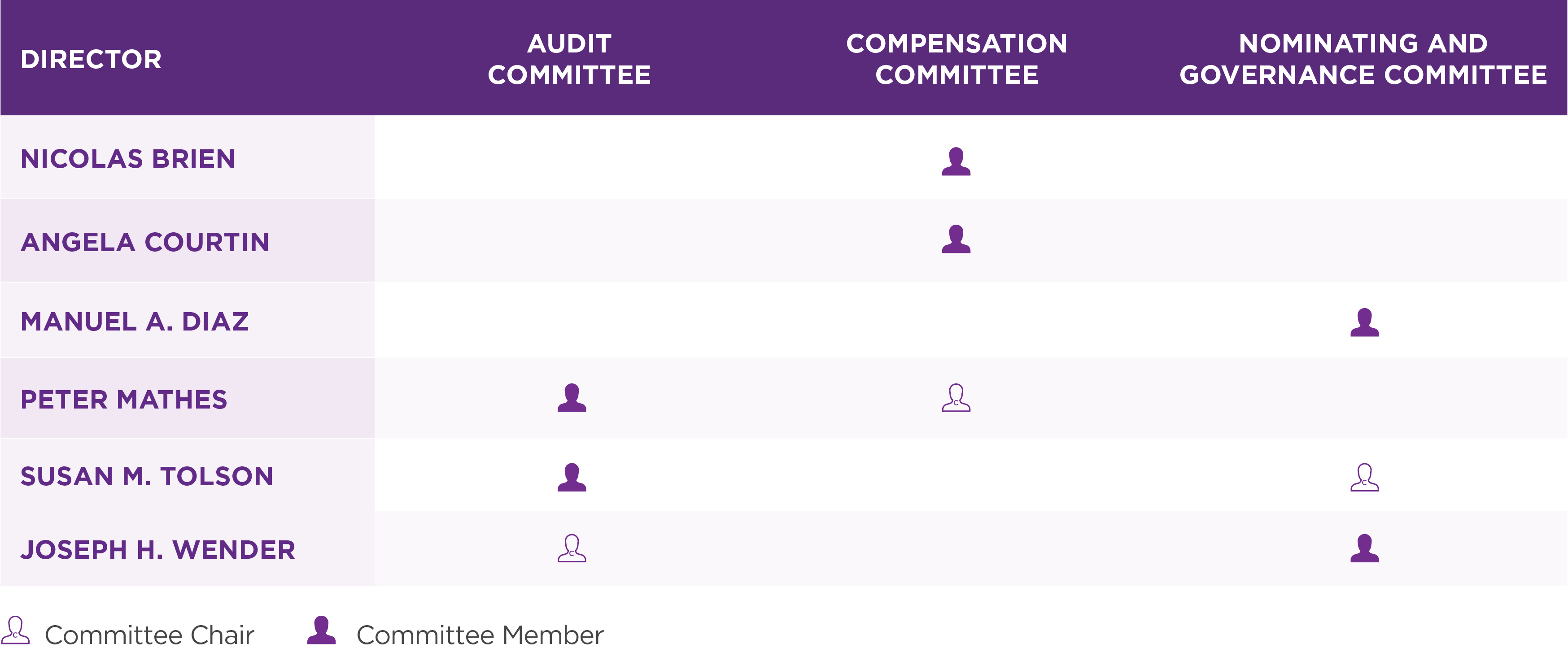

| | Nicolas Brien Member since 2014 Independent Director |

Mr.

Apfelbaum brings to the Board expertise relevant to the operation and strategic growth of our business.Nicolas Brienhas served on the Board since October 2014. He has served as Chief Strategy Officer of Velocity Acquisition Corp. since February 2021. Prior to that, he served as Chief Executive Officer, the Americas and U.S., of Dentsu Aegis Network Ltd. from August 2017 to December 2019, and as a consultant to Dentsu Aegis Network Ltd. from January 2020 to March 2020. He served as the Chief Executive Officer of iCrossing, a subsidiary of Hearst Corporation, and as President of Hearst Magazines Marketing Services, a division of Hearst Corporation, sincefrom March 2015.2015 to July 2017. Prior to that, he served as Chairman and Chief Executive Officer of McCann Worldgroup from April 2010 through November 2012, and as Chief Executive Officer of IPG Mediabrands from 2008 to 2010. Mr. Brien also served as Chief Executive Officer of Universal McCann from 2005 to 2008. We believe Mr. Brien is qualified to serve as a member of the Board because with over 30 years of experience in the advertising, media and marketing industry, Mr. Brien brings to the Board a unique cross-disciplinary perspective, extensive operational experience and expertise working with world-class brands.

| | | | | | | | |

| | Angela Courtin Member since 2017 Independent Director |

Ms. Courtin has served on the Board since April 2017. She has served as Global Head of YouTube TV and Originals Marketing since July 2017. She served as the Chief Marketing Officer of Fox Broadcasting Company from August 2015 to March 2017. Prior to that, she served as Chief Marketing Officer of Relativity Media LLC from July 2014 to July 2015. In July 2015, Relativity Media LLC filed for reorganization under bankruptcy laws after failing to make required loan payments, and subsequently exited bankruptcy in April 2016. Ms. Courtin also served as President of Dentsu Aegis Network Ltd. from August 2013 to July 2014 and President of The Story Lab from July 2012 to January 2014. Ms. Courtin also served in different roles at Aegis Media, including as the Chief Content Officer from August 2012 to August 2013, and Executive Vice President, Content & Convergence from March 2011 to July 2012. Ms. Courtin served on the board of directors of Vapor Corp. (now known as Healthier Choices Management Corp.) from April 2014 to June 2015. We believe Ms. Courtin is qualified to serve as a member of the Board because with over 20 years of experience in the advertising, media and marketing industry, Ms. Courtin brings to the Board a knowledgeable perspective on the impact advertising, marketing and media have in the digital world.

| | | | | | | | |

| | Manuel A. Diaz Member since 2014 Independent Director |

Mr. Diazhas served on the Board since August 2014. He is a senior partner at the law firm Lydecker Diaz, LLP and serves on a number of private company and not-for-profit boards.

Since January 2021, Mr. Diaz has served as the chair of the Florida Democratic Party. Prior to that, Mr. Diaz served as the Mayor of the City of Miami from 2001 to 2009. We believe Mr. Diaz is qualified to serve as a member of the Board because with over 30 years of combined public service and legal experience, Mr. Diaz brings to the Board a unique perspective on our governmental relationships and the impact we have on the local markets we serve.

Jeremy

| | | | | | | | |

| | Michael J. Dominguez Member since 2020 Independent Director |

Michael J. Dominguez has served on the Board since June 2020. He has served as a Managing Director of Providence Equity Partners L.L.C. since 2006, and in various other roles at Providence Equity Partners L.L.C. since July 1998. Prior to that, Mr. Dominguez worked at Salomon Smith Barney in corporate finance, and held positions with Morgan Stanley and as a senior consultant at Andersen Consulting. Mr. Dominguez served on the board of directors of CDW Corporation from October 2007 to June 2016. He has also served on, and is a current member of, the boards of directors of numerous private companies. We believe Mr. Dominguez is qualified to serve as a member of the Board because with over 25 years of experience in finance covering the media and communications industries as an investor, partner and director, Mr. Dominguez brings to the Board a thorough knowledge of public company financial reporting, corporate finance, strategic planning and corporate governance matters.

| | | | | | | | |

| | Jeremy J. Male Member since 2014 Chairman of the Board and Chief Executive Officer |

Mr. Malehas served as the Company’s Chief Executive Officer since September 2013, as a member of the Board since March 2014, and as Chairman of the Board since October 2014. Prior to that, he served as the Chief Executive Officer, UK, Northern Europe and Australia for JCDecaux SA since 2000, with operational responsibilities for 11 countries. He also served as a Member of the Executive Board at JCDecaux SA from October 2000 to September 2013. Prior to that, he served as Chief Executive Officer, Europe, of TDI Worldwide Inc. (which was later acquired by the Company). With his long and successful career in senior management positions at a number of highly regarded global outdoor companies, his executive board experience, and his service both as Chairman of the Outdoor Media Centre in the UK and President of FEPE International, each an association of outdoor advertising companies worldwide, Mr. Male brings to us unparalleled global expertise in the outdoor advertising industry and is well positioned to lead the Company, through his executive and director roles. We believe Mr. Male is qualified to serve as a member of the Board because of his outdoor advertising industry and management experience, his board service and the perspective he brings

onto our business as our Chairman and Chief Executive Officer.

| | | | | | | | |

| | Peter Mathes Member since 2014 Independent Director |

Mr. Matheshas served on the Board since March 2014. Mr. Mathes served as the Chairman and Chief Executive Officer of AsianMedia Group LLC from 2004 to September 2011. Prior to that, he served in various managerial roles, beginning in 1982 at Chris Craft/United Television Group, where he served as Executive Vice President from 1998 to 2001. In January 2012, AsianMedia Group LLC filed for reorganization under bankruptcy laws as a result of a significant decline in U.S. television spot advertising demand beginning in 2008, and, after selling its television stations, filed to liquidate its remaining assets. The case closed in July 2013. We believe Mr. Mathes is qualified to serve as a member of the Board because with over 30 years of combined experience in developing, acquiring and overseeing television stations and managing local and national advertising sales, Mr. Mathes brings to the Board expertise in local and national advertising strategy and development.

| | | | | | | | |

| | Susan M. Tolson Member since 2014 Independent Director |

Ms. Tolsonhas served on the Board since August 2014. She served as an analyst and portfolio manager at Capital Research Company for over twenty20 years. Prior to that, Ms. Tolson spent two years with Aetna Investment Management Company. Ms. Tolson currently serves on the board of directors of Lagardere Groupe,Group, Worldline E-Payment ServicesSA and Take-Two Interactive Software, Inc., as well as on thetheir audit committees of Worldline E-Payment Services and Take-Two Interactive Software, Inc. and the nominating and compensation committees of Worldline E-Payment Services.

committees. We believe Ms. Tolson is qualified to serve as a member of the Board because with extensive experience in the media industry, in investment management and in public company board service, Ms. Tolson provides the Board with a skilled advisor on strategic developments in our industry, as well as corporate finance and corporate governance matters.

| | | | | | | | |

| | Joseph H. Wender Member since 2014 Lead Independent Director |

Mr. Wenderhas served on the Board since March 2014, and has served as Lead Independent Director since February 2015. He has

also been a Senior Consultantserved as an Advisory Director to Goldman Sachs & Co.

LLC since January 2008. He began with Goldman, Sachs & Co. in 1971 and became General Partner of the firm in 1982, at which time he headed the Financial Institutions Group for over a decade. Mr. Wender also currently serves as a director

as well as on the audit and compensation committees of Ionis Pharmaceuticals, Inc.

andMr. Wender served as a director of Grandpoint Capital, a bank holding company

from January 2008 to June 2018 and

isas an Independent Trustee of the Schwab Family of

Funds.Funds until December 2018. We believe Mr. Wender is qualified to serve as a member of the Board because with over

3540 years of investment banking experience and his service on other boards, Mr. Wender brings to the Board a broad and deep understanding of public company financial reporting, corporate finance and strategic transactions.

Election

and Classification of Directors

In accordance with

At the

terms2019 Annual Meeting of Stockholders, at the recommendation of the

Board, the stockholders voted to approve amendments to the Charter

to declassify the Board

is divided into three classes, Class I, Class II and

Class III, with each class serving staggered three-year terms, and is divided as follows:provide for an annual election of all directors. The amendment to the Charter provides for the declassification of the Board to be completed following the Annual Meeting. Accordingly, at the Annual Meeting, the Class I directors, are Messrs. Diaz, Dominguez and Mathes and Ms. Tolson will stand for election, and, if elected, will serve until the 2022 Annual Meeting of Stockholders and until their term will expire atrespective successors are duly elected and qualify. As a result, beginning with the annual meeting2022 Annual Meeting of stockholders expected to be held in 2018;

the Class II directors are Messrs. Apfelbaum and Brien, and their term will expire at the Annual Meeting; and

the Class III directors are Messrs. Male and Wender, and their term will expire at the annual meeting of stockholders expected to be held in 2017.

At each annual meeting of stockholders, upon the expirationStockholders, all members of the term of a class of directors, the successor to each such director in the classBoard will be elected to serve from the time of election and qualification until the thirdnext annual meeting following his or her electionof stockholders and until his or her successor istheir respective successors are duly elected and qualifies, in accordance withqualify.

For information regarding the

Bylaws. Any additional directorships resulting from an increase inapplicable voting standards for the

numberelection of directors

will be distributed amongand the

three classes so that, as nearly as possible, each class will consist of one-third ofCompany’s director resignation policy, see the

directors.section entitled “General Information About the Annual Meeting and Voting.”

Director Nominations Process

The Nominating and Governance Committee is responsible for reviewing and making recommendations to the Board regarding nominations of candidates for election as a director of the Company. The Nominating and Governance Committee works with the Board to annually review the composition of the Board (the “Nominating and Governance Committee”) and Mr. Apfelbaum have collectively determined thatin light of the Company would be best served if Mr. Apfelbaum acted as a management consultantcharacteristics of independence, diversity, skills, experience, availability of service to the Company, where his over 35 yearstenure of experienceincumbent directors on the Board and the Board’s anticipated needs. The Nominating and Governance Committee will recommend director candidates to the Board in accordance with the criteria, policies and principles set forth in the outdoor advertising industry, particularlyCompany’s Corporate Governance Guidelines.

In accordance with respect to transit advertising, could be utilized more directly. Accordingly, from and after June 8, 2016, Mr. Apfelbaum will serve as a paid management consultant to the Company for transit-related matters, and Mr. Apfelbaum andCompany’s Corporate Governance Guidelines, in evaluating the suitability of individual Board members, the Nominating and Governance Committee have agreedtakes into account all relevant factors, including, but not limited to, the individual’s accomplishments in his or her professional background, current or former leadership positions held by the individual, whether the individual is able to make independent, analytical inquiries and exhibit practical wisdom and mature judgment, and other directorships held by the individual. Directors of the Company are also expected to possess the highest personal and professional ethics, integrity and values and be committed to promoting the long-term interests of the Company and its stockholders. As part of its review, the Nominating and Governance Committee also considers diversity characteristics, including, but not limited to, the individual’s age, gender, race, ethnicity and/or self-identified diversity characteristics such as religion, nationality, disability, sexual orientation, military service, cultural background and socio-economic characteristics. As a result of considering diversity characteristics as part of its nomination process, the Board includes two female directors, a director who is a member of the lesbian, bisexual, gay and transgender community, a Hispanic director and directors within an age range spanning nearly thirty years. Distinguished contributors to governmental and not-for-profit organizations also serve on the Board. Additionally, multiple industries are represented on the Board, including law, advertising, media and marketing, investment management and banking. After taking all of these considerations into account, the Nominating and Governance Committee determined to recommend to the Board that he will notMessrs. Diaz, Dominguez, Mathes and Ms. Tolson, each of whom is currently a Class I member of the Board, be nominated as a directorto stand for re-electionelection at the Annual Meeting. On April 7, 2016,

An eligible stockholder or group of stockholders that wants to nominate directors for inclusion in the Company’s proxy statement pursuant to the proxy access provisions in the Bylaws, or that wants to nominate or recommend a candidate for election to the Board votedwithout such nominee being included in the Company’s proxy statement, must send a written notice to reducethe Company’s Corporate Secretary at OUTFRONT Media Inc., 405 Lexington Avenue, 17th Floor, New York, New York 10174 and follow the requirements set forth in the Bylaws. See “Stockholder Proposals for the 2022 Annual Meeting of Stockholders.” The Company’s Corporate Secretary will review the information received about the stockholder candidate and determine whether such person meets the qualifications for the

Company’s directors set forth in the Company’s Corporate Governance Guidelines and satisfies the requirements of the Bylaws, as applicable. If all applicable requirements are met, the information on the stockholder candidate will then be forwarded to the Chair of the Nominating and Governance Committee, who will present the information on the stockholder candidate to the entire Nominating and Governance Committee. Director candidates recommended by stockholders will be considered by the Board in the same manner as any other candidate. A copy of the Company’s Corporate Governance Guidelines is available in the Investor Relations section of our website at www.outfrontmedia.com.

Board and Committee Self-Evaluations

Pursuant to the Company’s Corporate Governance Guidelines and the NYSE listing standards, the Board and its size from sevencommittees each conduct a self-evaluation annually. Our processes enable directors to six directors, effectiveprovide anonymous and confidential feedback and the directors’ responses are summarized in reports by the Corporate Secretary and then reviewed by the Chairman, the Lead Independent Director and the respective chairs of the committees. The feedback is discussed at the commencementBoard and committee meetings and changes in practices or procedures are considered and implemented, as appropriate. The Board finds that this process generates robust comments, and provides the Board the opportunity to make changes designed to increase Board effectiveness and efficiency.

The Nominating and Governance Committee regularly reviews the format of the Annual Meeting.self-evaluation process, including whether to utilize a third-party facilitator, to ensure that actionable feedback is solicited on the operation and effectiveness of the Board and its committees. In 2020, the self-evaluation process was conducted by the Corporate Secretary, at the direction of the Chair of the Nominating and Gov

ernance Committee in the manner described above, and directors provided feedback on questionnaires regarding various matters, including, but not limited to, Board composition and structure, meetings and materials, access to management and resources, director education, and key areas of focus for the Board such as environmental, social and corporate governance (“ESG”) matters, which were considered and addressed, as appropriate. In addition to the formal self-evaluation process, the Chairman, Lead Independent Director and independent directors and senior members of management have informal discussions throughout the year about the function, processes, procedures and responsibilities of the Board.

In accordance with the NYSE rules and the Company’s Corporate Governance Guidelines, the Company’s Board of Directors will makemakes an annual determination as to the independence of the directors and director nominees. The Board also makes interim determinations as to the independence of the directors and director nominees throughout the year, as appropriate. A director or director nominee is not deemed independent unless the Board affirmatively determines that such director or director nominee has no material relationship with the Company, directly or as an officer, stockholder or partner of an organization that has a relationship with the Company. TheIn its assessment, the Board will observereviews (i) all criteria for independence established by the Company’s Corporate Governance Guidelines, the NYSE listing standards and other governing laws and regulations. When assessing materiality of a director’s relationship with the Company, the Board will considerregulations and (ii) all relevant facts and circumstances, not merely from the director’s standpoint, but from that of the persons or organizations with which the director has an affiliation, andincluding, but not limited to, the frequency of any services provided to or regularity ofby the services,Company, whether the services are being carried out at arm’s length in the ordinary course of business and whether the services are being provided substantially on the same terms to the Company as those prevailing at the time from unrelated parties for comparable transactions. Material relationships can include any commercial, banking, consulting, legal, accounting, charitable or other business relationships eachbetween a director or director nominee may have withand the Company. In addition, the Board will consultannually consults with the Company’s external legal counsel to ensure that the Board’s determinations are consistent with all relevant securities laws and other applicable laws and regulations regarding the definition of “independent director,” including, but not limited to, those set forth in pertinentthe NYSE listing standardsstandards.

In assessing the independence of

Ms. Courtin, the

NYSE.Board considered the purchase, directly or indirectly, of out-of-home advertising from the Company by Ms. Courtin’s current employer. The Board noted that payments made to the Company were primarily by agencies contracted by Ms. Courtin’s employer (without influence by, or remuneration to, Ms. Courtin), and any such payments did not exceed the relevant percentage of her employer’s consolidated gross revenues set forth in the NYSE listing standards. In addition, the Board also noted that Ms. Courtin is not responsible for making any purchasing decisions regarding out-of-home advertising on behalf of her employer.

In assessing the independence of Mr.

Diaz,Brien, the Board considered

services that Lydecker Diaz LLP, a Florida law firmthe purchase of

which Mr. Diaz is a partner, provided to Van Wagner Communications, LLC, an entity whichout-of-home advertising from the Company

acquired on October 1, 2014, before the completion of the acquisition.by Mr. Brien’s former employer. The Board noted that

Mr. Diaz did not provide any services directlypayments made to the Company

beforewere made without influence by, or

afterremuneration to, Mr. Brien, and any such payments did not exceed the

acquisition.Therelevant percentage of his former employer’s consolidated gross revenues set forth in the NYSE listing standards.

In assessing the independence of Mr. Dominguez, the Board considered Mr. Dominguez’s employment as Managing Director at Providence Equity Partners LLC, whose affiliates currently beneficially own 275,000 shares of Series A Preferred Stock, which they received in the Private Placement (as defined and described in the section entitled “Certain Relationship and Related Transactions”).

In February 2021, the Nominating and Governance Committee undertook its annual review of director independence and,

in consultation with external legal counsel, made a recommendation to the Board regarding director independence. As a result of this review, the Board affirmatively determined that

sixseven of our current directors, Messrs.

Apfelbaum, Brien, Diaz,

Dominguez, Mathes and Wender and

Ms.Mses. Courtin and Tolson, are “independent directors” under the Company’s Corporate Governance Guidelines and the NYSE listing standards.

Board Leadership Structure

The Board leadership structure is currently comprised of (1) a combined

role of Chairman of the Board

of Directors and Chief Executive Officer, (2) a Lead Independent Director, and (3) an independent Chair for each of our three standing Board committees described below.

From time to time,Regularly, the Nominating and Governance Committee and the

entire Board review the Company’s leadership structure

including the positions of Chairman of the Board and Chief Executive Officer, to ensure the interests of the Company and its stockholders are best served.

The Nominating and Governance Committee hasand the Board have determined that it is in the best interestinterests of the Company for the positionsposition of Chief Executive Officer and Chairman to be held by a single individual,our Chief Executive Officer, Jeremy J. Male. By serving as both our Chairman and Chief Executive Officer, Mr. Male is able to provide strong and consistent leadership, vision and direction as we pursue ourto effectively execute the Company’s business plans.strategies. Mr. Male has extensive knowledge of all aspects of the Company, itsCompany’s business, industry, customers and risks its industry and its customers. Heas he is intimately involved in the Company’s day-to-day operations of the Company and, therefore, is in the best position to elevate the most critical business issues for consideration by the Board. The Board believes having Mr. Male serve in both capacities allows him to more effectively execute the Company’s strategic initiatives and business plans and confront its challenges. The Board also believes thatIn addition, the combined Chairman and Chief Executive Officer structure creates more focused, efficient and effective information flow and decision-making processes, which in turn provides clearer accountability to our stockholders and customers and allowsby allowing one person to speak for and lead both the Company and the Board. In addition, the Board believes that its information flow, meetings, deliberations, and decision-making processes are more focused, efficient, and effective when the

The combined role of Chairman and Chief Executive Officer

roles are combined. The combined role is counterbalanced and enhanced by the effective oversight and independence of the Board and the leadership of the Lead Independent Director and independent committee chairs. Moreover, the Board believes that the

appointment of a strong Lead Independent Director and the use of regular executive sessions of the

non- managementnon-management and independent directors

along withallows the

Board’s strong committee system and all directors being independent except for Mr. Male, allow itBoard to maintain effective oversight of management. In our view, splitting the roles would potentially make our management and governance processes less effective through undesirable duplication of work and possibly lead to a blurring of clear lines of accountability and responsibility.

The Lead Independent Director is elected by a majority of independent directors to serve for a one-year term at the pleasure of the Board of Directors.Board. Our current Lead Independent Director, is Joseph H. Wender. Mr. Wender, is an engaged and active director, who is uniquely positioned to workworks collaboratively with Mr. Male, while providing strong independent oversight. oversight. As described in the Company’s Corporate Governance Guidelines, the Lead Independent Director has broad responsibility and authority, including, but not limited to:

•presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors;

•calling meetings of independent directors;

•serving as the principal liaison among the Chairman, any other non-independent directors and the independent directors to facilitate discussion of issues discussed in the executive sessions and to ensure the flow of information;

•collaborating with the Chairman on meeting schedules, agendas and materials for the Board;

•being available, if requested, by major stockholders, for consultation and direct communication with stockholders;stockholders and proxy advisory firms;

•retaining outside advisors and consultants who report directly to the Board on Board-wide issues; and

•leading the performance assessment of the Chief Executive Officer and, in collaboration with the Nominating and Governance Committee, the Board’s self-assessment.

In addition to the above responsibilities and Mr. Wender’s service as a member of the Board,

of Directors, Mr. Wender has over the past year performed additional duties, including regularly communicating with the Chairman,

independent directors and

Chief Executive Officersenior members of management between Board meetings

to discuss a variety of matters, and

periodically meeting with the Chairman and Chief Executive Officer after executive sessions

of independent directors to provide feedback from the

other independent

directors. A copydirectors on a variety of

the Company’s Corporate Governance Guidelines is available in the Investor Relations section of our website atwww.outfrontmedia.com.matters.

The Board has overall responsibility for the oversight of the Company’s risk management process. The Board carries out its oversight responsibility directly and through the delegation to its committees of responsibilities related to the oversight of certain risks, as follows:

•The Audit Committee of the Board (the “Audit Committee”), as part of its oversight role, is responsible for reviewing with management, the internal auditor and the independent auditor, the effectiveness of the Company’s internal control over financial reporting, disclosure controls and procedures and risk management procedures related to, among other things, the Company’s financial condition, the independent auditor, market and industry conditions, legal, compliance and regulatory requirements, and information technology security and disaster recovery, among other responsibilities set forth in the Audit Committee’s charter.cybersecurity.

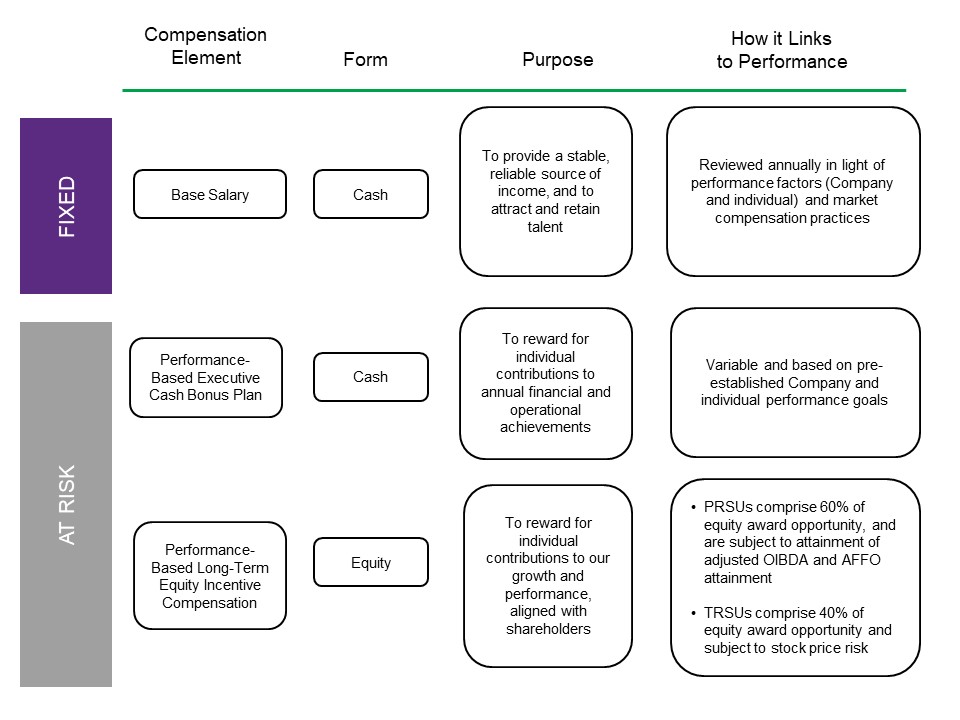

•The Compensation Committee of the Board (the “Compensation Committee”) monitors risks associated with the design and administration of the Company’s compensation programs, including its performance-based compensation, to promote an

environment which does not encourage unnecessary and excessive risk-taking by the Company’s employees. See “Executive Compensation—Compensation Discussion and Analysis—Compensation Risk Assessment.”

•The Nominating and Governance Committee assesses risk as it relates to monitoring developments in law and practice with respect to the Company’s corporate governanceESG processes and indisclosures, the independence and structure of the board, and reviewing related person transactions.

Each of these committees reports regularly to the Board on these risk-related matters. In addition, theThe Board and its committees also receive regular reports from management that include matters affecting the Company’s strategies and risk profile, including, among other things, operations things:

•reports from the Chief Executive Officer and from other senior members of management all of which include strategicon the Company’s operational strategies and operational risks;

•reports from the Chief Financial Officer on credit and liquidity risks and on the integrity of internal controlsaudit control over financial reporting; and

•reports from the General Counsel on legal risks and material litigation.legal proceedings;

•reports from the Chief Human Resources Officer on human capital risks, including diversity and inclusion matters; and

•reports from the Chief Information Officer (with input from the Company’s Chief Privacy Officer, as appropriate) on the Company’s information security and cybersecurity risks, compliance and protections.

In addition, the Company has an enterprise risk management program that seeks to identify and manage risks throughout the Company by having its Chief Financial Officer meet with members of each of the Company’s various departments annually to solicit feedback regarding risks affecting the Company. Based on these meetings, the Company’s Chief Financial Officer generates a risk assessment report that is presented to the Board. Further, since assessing risk is an ongoing process and integral to the Company’s strategic decisions, the Board discusses risk throughout the year at its meetings in relation to long-term and short-term business goals and actions, including with management at an annual strategy meeting. Outside of formal meetings, Board members have regular access to our executive

officers.officers and management. The

Board committee and management reports and real-time management accessCompany believes that the above reporting processes collectively provide the Board with integrated insight

oninto the Company’s management of its risks.

While

The Company also has an incident response plan that sets forth the processes for addressing the aftermath and associated risks of an event or incident, such as a cybersecurity incident or health emergency like the COVID-19 pandemic, affecting the Company does not currently maintainand/or its personnel. The incident response plan is tested at least annually by the Company and the results of the test are reported to the Audit Committee and the Board by the Company’s Chief Financial Officer for discussion and evaluation.

In addition, the Company maintains a written succession plan with respect to the Chairman and Chief Executive Officer

inand each executive officer. In accordance with the Company’s Corporate Governance Guidelines, the Nominating and Governance Committee

will review periodicallyreviews succession planning

at least annually for the Chairman and Chief Executive Officer and

others,other executive officers, and

reportreports to the independent directors on

the results of these reviews.

The Company

also believes that its board leadership structure, discussed in detail above, supports the risk oversight function of the

Board. WhileBoard and empowers the

Company has a combined Chairman and Chief Executive Officer,directors to be actively engaged in the

Lead Independent Director and independent committee chairs are actively involved inCompany’s risk

oversight, and there is open communication between management and directors regarding risk oversight.

Corporate Governance Guidelines

The Company’s commitment to good corporate governance is reflected in the Company’s Corporate Governance Guidelines, which describe the Board’s views on a wide range of governance topics, including, but not limited to, director independence standards and other qualifications, executive sessions of non-management directors and independent directors, director compensation and stock ownership guidelines, and annual

self- evaluationsself-evaluations of the Board. The Board, with assistance from its Nominating and Governance Committee, regularly assesses the Company’s governance practices in light of legal requirements and governance best practices.

The Company’s Corporate Governance Guidelines, the charters of the Audit Committee, the Compensation Committee and the Nominating and Governance Committee, and other information are available in the Investor Relations section of our website atwww.outfrontmedia.com. Any stockholder also may request them in print, without charge, by contacting the Company’s Corporate Secretary at OUTFRONT Media Inc., 405 Lexington Avenue, 17th Floor, New York, New York 10174.

Code of Conduct and Code of Ethics

The Company has adopted a Code of Conduct that applies to all executive officers, employees and directors of the Company. In addition, the Company has adopted a Supplemental Code of Ethics for Senior Financial Officers applicable to our principal executive officer, principal financial officer and principal accounting officer or controller or persons performing similar functions. Both the Code of Conduct and the Supplemental Code of Ethics are available in the Investor Relations section of our website atwww.outfrontmedia.com.

We intend to satisfy the disclosure requirements under Item 5.05 of Form 8-K regarding any amendment to, or waiver from, a provision of the Code of Conduct or the Supplemental Code of Ethics that applies to our principal executive officer, principal financial officer or principal accounting officer or controller or persons performing similar functions, and relates to any element of the definition of code of ethics set forth in Item 406(b) of Regulation S-K, by posting such information on our website atwww.outfrontmedia.com.

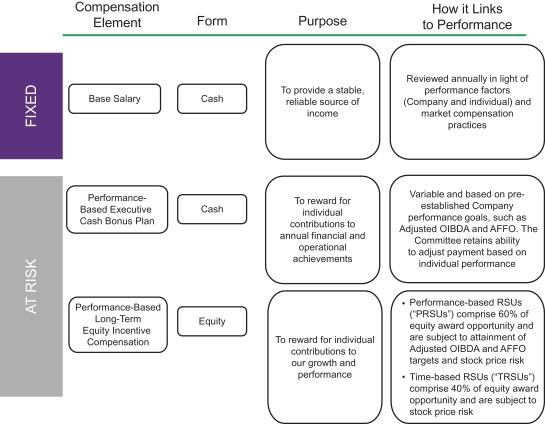

Anti-Hedging Policy